This month, as part of a new book, Start Here to Become a Teacher, NCTQ named 120 undergraduate programs that excel in preparing teacher candidates to meet the demands of their careers. Using nearly two decades of extensive research in teacher preparation, NCTQ assessed programs on critical, evidence-based measures, including:

- Rigorous admissions process

- Emphasis on research-based approaches to teaching reading and math for elementary candidates

- Content knowledge for secondary candidates

- Training in classroom management strategies that work for all students

- Quality student teaching experiences

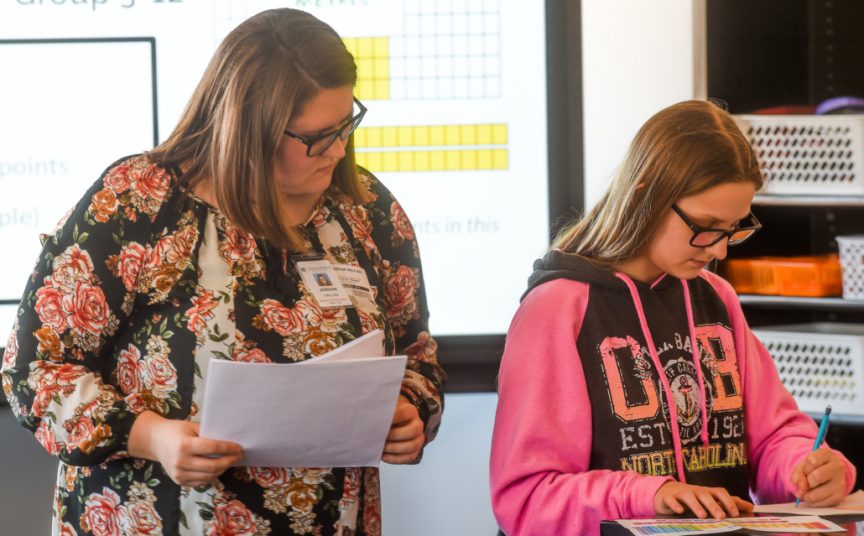

Of the 872 undergraduate programs reviewed, Lake Superior State University was recognized as a leader in the field.

“I am proud of all the hard work our faculty puts in to make LSSU’s teacher education program one of the nation’s best.” Dr. Rodney Hanley, LSSU President commented. “Our faculty developed this program to ensure students have real-world experience, and learn valuable classroom management skills that they will carry with them in their careers.”

“The universities named in Start Here are exemplary in their dedication to training the next generation of great teachers,” says Kate Walsh, NCTQ President and book author. “We commend these institutions for the thoughtful manner in which they’ve grounded their approach to teacher preparation in what research shows to actually be effective.”

IRA Charitable Rollover

You may be looking for a way to make a big difference to help further our mission. If you are 701/2 or older you may also be interested in a way to lower the income and taxes from your IRA withdrawals. An IRA charitable rollover is a way you can help continue our work and benefit this year.

Benefits of an IRA Charitable rollover

- Avoid taxes on transfers of up to $100,000 from your IRA to the Lake Superior State University Foundation

- Satisfy your required minimum distribution (RMD) for the year

- Reduce your taxable income, even if you do not itemize deductions

- Make a gift that is not subject to the deduction limits on charitable gifts

- Help further the work and mission of Lake Superior State University

How an IRA charitable rollover gift works

- Contact your IRA plan administrator to make a gift from your IRA to us.

- Your IRA funds will be directly transferred to Lake Superior State University to help continue our important work.

- Please note that IRA charitable rollover gifts do not qualify for a charitable deduction.

- Please contact us at [email protected] or 906-635-2665, if you wish for your gift to be used for a specific purpose.

About the Author

Stephanie Roose

Stephanie RooseMarketing Content Coordinator

Stephanie Roose graduated in 2009 with a BA from Lake Superior State University and has since been working in sales, marketing, and public relations. Roose relocated back home to Sault Ste. Marie, joining the LSSU Marketing and Communications team in January.